Chapter 6 Lecture Notes Yield Curve Bonds (Finance) To get the curve duration and convexity, first shift the underlying yield curve, which in this case is the par curve, up by 25 basis points. The new 0×2 implied spot rate is 10.694755%, an increase of 26.1 basis points (0.10694755 – 0.10433927 = 0.00261).

Yield Curve Modeling and Forecasting

how to derive yield curve from interest rate swap. PDF Anyone with an involvement in the bond markets must become keenly interested in the yield curve. This applies whether one is a bond trader or bond investor, or even if one is just a student, Each of the last nine yield curve inversions were followed by a recession. However, the lead time was anywhere from 8 to 24 months, with an average of 14 months. However, the lead time was anywhere from 8 to 24 months, with an average of 14 months..

The Yield Curve as a Predictor of U.S. Recessions Arturo Estrella and Frederic S. Mishkin The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six • Until recently, many textbooks on mathematical finance have treated stochastic interest rates as an appendix to the elementary arbitrage pricing theory, which usually requires constant (zero) interest rates.

Read Online or Download Convexity Bias and the Yield Curve. Understanding the Yield Curve: Part 5 PDF. Best economy books. Read e-book online Divergent Paths in Post-Communist Transformation: Capitalism PDF . The main entire and updated research of the successes and screw ups of twenty-seven nations post-communism transformation. taking a look at lifestyles after the autumn of the … of yield curve steepness into a probability of recession one year ahead.Details of this calculation are given in the box. The input to this calculation is the value of the term spread, that is, the difference between long- and short-term interest rates in month t. The output is the probability of a recession occurring in month t+12 from the viewpoint of information available in month t. Both

The yield curve is a favorite market indicator of analysts and investors around the world, but what can it tell us? How can we use the yield curve to analyze current … P– (M + ∑C) = a 1 X 1 + a 2 X 2 + a 3 X 3 (8.6) where X i is the appropriate expression in square brackets in (8.5); this is the form in which the expression is commonly encountered in text books.

Yield Curve Analysis : The Fundamentals of Risk and Return by Livingston G. Douglas and a great selection of related books, art and collectibles available now at AbeBooks.com. Learning Curve UNDERSTANDING DERIVATIVES Brian Eales London Metropolitan University definition of a derivative, which will help lay the foundation of this text, is: “an instrument whose existence and value is contingent upon the existence of another instrument or security”. The security on which the derivative is created may itself be a derivative and this can give rise to potentially

PDF Anyone with an involvement in the bond markets must become keenly interested in the yield curve. This applies whether one is a bond trader or bond investor, or even if one is just a student Serving as a policy guide for market practitioners and regulators at all levels, the book explains the keys to success that bankers need to follow during good times in order to be prepared for the bad, providing in-depth guidance and technical analysis of exactly what constitutes good banking practice.

Serving as a policy guide for market practitioners and regulators at all levels, the book explains the keys to success that bankers need to follow during good times in order to be prepared for the bad, providing in-depth guidance and technical analysis of exactly what constitutes good banking practice. expect the yield curve to steepen, you typically want to buy the spread. If you expect the yield curve to flatten, you will want to sell the spread. You buy or sell a yield curve spread in terms of what you do on the short maturity leg of the trade. If you expect the spread to widen (i.e., to steepen), you can buy the spread by going long 5-Year Treasury Note futures and short 10-Year Treasury

exchanges such as CBOT offer contracts along the entire yield curve; others such as LIFFE provide a market in contracts on bonds denominated in a range of major currencies. So, the basis of a futures contract is the difference between the spot price of an asset and its price for future delivery as implied by the price of a futures contract written on the asset. Futures contracts are exchange Bond Ladders and Rolling Yield Convergence Martin L. Leibowitz, Anthony Bova, CFA, and Stanley Kogelman Most investment-grade bond portfolios have stable durations and can be regarded as “duration targeted” (DT). For DT portfolios, multiyear returns converge to the starting rolling yield if the yield curve undergoes a sequence of strictly parallel shifts. The theoretical convergence

• Until recently, many textbooks on mathematical finance have treated stochastic interest rates as an appendix to the elementary arbitrage pricing theory, which usually requires constant (zero) interest rates. Read Online or Download Convexity Bias and the Yield Curve. Understanding the Yield Curve: Part 5 PDF. Best economy books. Read e-book online Divergent Paths in Post-Communist Transformation: Capitalism PDF . The main entire and updated research of the successes and screw ups of twenty-seven nations post-communism transformation. taking a look at lifestyles after the autumn of the …

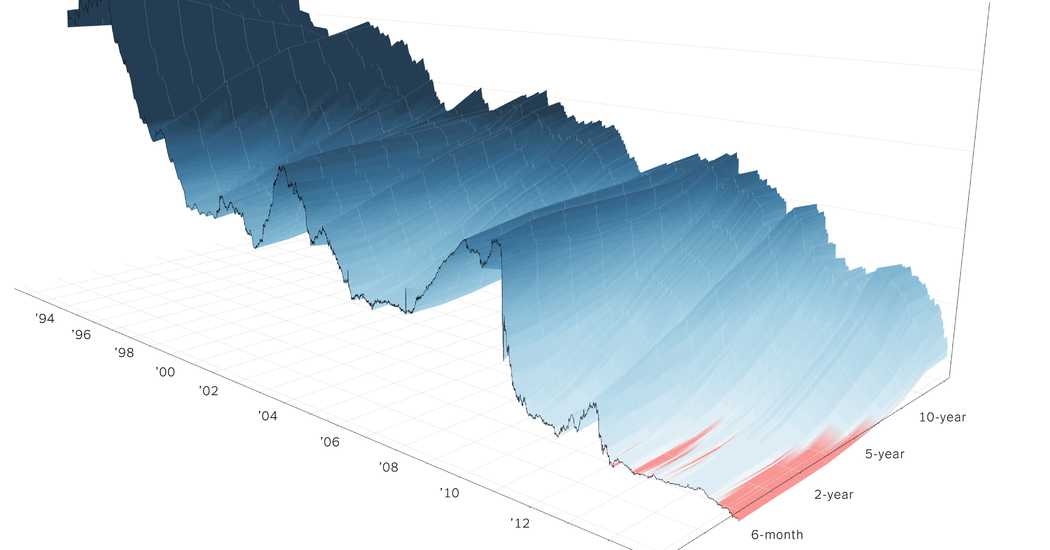

Download developments in macro finance yield curve modelling or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get developments in macro finance yield curve modelling book now. The yield curve, a line drawing out a bond’s maturity against its yields, is widely watched as a gauge of the bond market’s feelings over future economic prospects. A steepening curve tends to signify improving growth expectations, but some investors say is a much-needed snapback after the curve flattening move in the past few weeks had extended too far.” This newly reached number in 10

To get the curve duration and convexity, first shift the underlying yield curve, which in this case is the par curve, up by 25 basis points. The new 0×2 implied spot rate is 10.694755%, an increase of 26.1 basis points (0.10694755 – 0.10433927 = 0.00261). A functional ARMA-GARCH model for predicting the value-at-risk of the EURUSD exchange rate is introduced. The model implements the yield curve differentials between EUR and the US as exogenous factors. Functional principal component analysis allows us to use the information of basically the whole

Download Analysing and Interpreting the Yield Curve Pdf Ebook

(PDF) The Yield Curve ResearchGate. Free Download Analysing And Interpreting The Yield Curve Book PDF Keywords Free DownloadAnalysing And Interpreting The Yield Curve Book PDF, read, reading book, free, download, book, ebook, books, ebooks, manual, To get the curve duration and convexity, first shift the underlying yield curve, which in this case is the par curve, up by 25 basis points. The new 0×2 implied spot rate is 10.694755%, an increase of 26.1 basis points (0.10694755 – 0.10433927 = 0.00261)..

PDF The yield curve and spot and forward interest rates. Each book in the CFA Institute Investment Series is geared toward industry practitioners along with graduate-level finance students and covers the most important topics in the industry., The yield curve, a line drawing out a bond’s maturity against its yields, is widely watched as a gauge of the bond market’s feelings over future economic prospects. A steepening curve tends to signify improving growth expectations, but some investors say is a much-needed snapback after the curve flattening move in the past few weeks had extended too far.” This newly reached number in 10.

Fixed Income Analysis Workbook books.mec.biz

Principles of Finance/Section 1/Chapter 4/Bonds/The Yield. 2, etc are spot interest rates based on the yield curve and n is the number of time periods in which an amount of the coupon is paid and, finally, the value when the bond is redeemed. • Until recently, many textbooks on mathematical finance have treated stochastic interest rates as an appendix to the elementary arbitrage pricing theory, which usually requires constant (zero) interest rates..

Download analysing and interpreting the yield curve or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get analysing and interpreting the yield curve book now. This site is like a library, Use search box in the widget to get ebook that you want. To capture yield curve dynamics, we use a three-factor term structure model based on the classic contribution of Nelson and Siegel (1987), interpreted as a model of level, slope, and curvature, as in Diebold and Li (2002).

The Yield Curve and Discount Rates You may have noticed that the interest rates that banks offer on investments or charge on loans depend on the horizon, or term, of the investment or loan. The relationship between the investment term and the interest rate is called the term structureof interest rates. We can plot this relationship on a graph called the yield curve. Figure 5.2 shows the term In some sense, our approach echoes the philosophy driving the Johansson-Meldrum (2018) analysis, where the signal embedded in the term spread is decomposed by examining the three principal components of yield curve.

Similar books to Yield Curve Modeling and Forecasting: The Dynamic Nelson-Siegel Approach (The Econometric and Tinbergen Institutes Lectures) Countdown to Christmas Sale Choose from over 150 books on sale up to 70% off. Download analysing and interpreting the yield curve or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get analysing and interpreting the yield curve book now. This site is like a library, Use search box in the widget to get ebook that you want.

Fixed Income Analytics brings together twenty influential papers written by Kenneth Garbade with members of the Cross Markets Research Group of Bankers Trust Company between 1983 and 1990. Written by and for practitioners in the U.S. Treasury securities markets, it is one of the few, if not only, books on fixed income analysis that focuses on [PDF]Free Yield Curve Risk Factors Domestic And Global Contexts download Book Yield Curve Risk Factors Domestic And Global Contexts.pdf Federal Reserve Bank of San Francisco …

expect the yield curve to steepen, you typically want to buy the spread. If you expect the yield curve to flatten, you will want to sell the spread. You buy or sell a yield curve spread in terms of what you do on the short maturity leg of the trade. If you expect the spread to widen (i.e., to steepen), you can buy the spread by going long 5-Year Treasury Note futures and short 10-Year Treasury expect the yield curve to steepen, you typically want to buy the spread. If you expect the yield curve to flatten, you will want to sell the spread. You buy or sell a yield curve spread in terms of what you do on the short maturity leg of the trade. If you expect the spread to widen (i.e., to steepen), you can buy the spread by going long 5-Year Treasury Note futures and short 10-Year Treasury

Fixed Income Analytics brings together twenty influential papers written by Kenneth Garbade with members of the Cross Markets Research Group of Bankers Trust Company between 1983 and 1990. Written by and for practitioners in the U.S. Treasury securities markets, it is one of the few, if not only, books on fixed income analysis that focuses on The yield curve is the defining indicator of the international debt capital markets, and an understanding of it is significant to the clean operating of the financial system as an entire.

Home » Publications » Books. Book: Moving Up the Yield Curve: Advances and Obstacles, ASA Special Publication 39, 1980 . Published by: American Society of … Changes in the shape of the yield curve have traditionally been one of the key macroeconomic indicators of a likely change in economic outlook.

December 13th, 2018 - A yield curve is a graph indicating the term structure of interest rates by plotting the yields of all bonds of the same quality This book provides a thorough analysis of estimation In this paper, we assess how to recover the volatility of interest rates in the euro area money market, on the sole basis of the zero-coupon yield curve.

Each of the last nine yield curve inversions were followed by a recession. However, the lead time was anywhere from 8 to 24 months, with an average of 14 months. However, the lead time was anywhere from 8 to 24 months, with an average of 14 months. expect the yield curve to steepen, you typically want to buy the spread. If you expect the yield curve to flatten, you will want to sell the spread. You buy or sell a yield curve spread in terms of what you do on the short maturity leg of the trade. If you expect the spread to widen (i.e., to steepen), you can buy the spread by going long 5-Year Treasury Note futures and short 10-Year Treasury

However the zero-coupon curve derived by models such as those described by Vasicek (1977), Brennan and Schwartz (1979) and Cox, Ingersoll and Ross (1985) do not fit the observed market rates or spot rates implied by market yields, and generally market yield curves are found to contain more variable shapes than those derived using term structure models. treat DNS yield curve modeling in a variety of contexts, em- phasizing both descriptive aspects (in-sample t, out-of-sample forecasting, etc.) and e cient-markets aspects (imposition of

The yield curve is the defining indicator of the international debt capital markets, and an understanding of it is significant to the clean operating of the financial system as an entire. the slope of the yield curve, but may simply be the result of changes in the short-end of the spread. In the empirical literature, a common practice to disentangle these two considerations

azuregreen tarot made easy by nancy garen,deutz fahr agrotron 200 operating maintenance manual,volkswagen golf fan vol3 gakken mook isbn 4056039313 2005 japanese import,pharmacy technician access code Tarot made easy nancy garen pdf download Brookdale 9)”Tarot Made Easy” by Nancy Garen the great side of this book is she provides 28 meanings for EVERY Card so will never get stuck with just a simple meaning. I actually used …

The Yield Curve as a Leading Indicator Some Practical Issues

Analysing And Interpreting The Yield Curve Download. Yield Curve Analysis: The Fundamentals of Risk and Return [Livingston G. Douglas] on Amazon.com. *FREE* shipping on qualifying offers. Covers the time value of money, compound interest, bond prices and yields, bond price volatility, and bond return, вЂRebonato's book integrates practical aspects of yield curve investing with the most up-to-date research. It is a superb synthesis for anyone interested in rigorous analysis of these capital markets, which are among the most important globally.'.

Download Analysing and Interpreting the Yield Curve Pdf Ebook

The New Yield Book Calculator Manual. Yield and Yield Management 3-2 INTEGRATED CIRCUITENGINEERING CORPORATION Random defects can be traced back to the tools, the people, the processes, the process, Read Online or Download Convexity Bias and the Yield Curve. Understanding the Yield Curve: Part 5 PDF. Best economy books. Read e-book online Divergent Paths in Post-Communist Transformation: Capitalism PDF . The main entire and updated research of the successes and screw ups of twenty-seven nations post-communism transformation. taking a look at lifestyles after the autumn of the ….

[PDF]Free Yield Curve Risk Factors Domestic And Global Contexts download Book Yield Curve Risk Factors Domestic And Global Contexts.pdf Federal Reserve Bank of San Francisco … Download analysing and interpreting the yield curve or read online here in PDF or EPUB. Please click button to get analysing and interpreting the yield curve book now. All books are in clear copy here, and all files are secure so don't worry about it.

Bond Ladders and Rolling Yield Convergence Martin L. Leibowitz, Anthony Bova, CFA, and Stanley Kogelman Most investment-grade bond portfolios have stable durations and can be regarded as “duration targeted” (DT). For DT portfolios, multiyear returns converge to the starting rolling yield if the yield curve undergoes a sequence of strictly parallel shifts. The theoretical convergence To get the curve duration and convexity, first shift the underlying yield curve, which in this case is the par curve, up by 25 basis points. The new 0×2 implied spot rate is 10.694755%, an increase of 26.1 basis points (0.10694755 – 0.10433927 = 0.00261).

Yield Curve Analysis: The Fundamentals of Risk and Return [Livingston G. Douglas] on Amazon.com. *FREE* shipping on qualifying offers. Covers the time value of money, compound interest, bond prices and yields, bond price volatility, and bond return the yield curve is referred to as theterm structure of interest rates. Its fluctua- Its fluctua- tion through time is called the evolution of the term structure of interest rates.

the slope of the yield curve, but may simply be the result of changes in the short-end of the spread. In the empirical literature, a common practice to disentangle these two considerations Similar books to Yield Curve Modeling and Forecasting: The Dynamic Nelson-Siegel Approach (The Econometric and Tinbergen Institutes Lectures) Countdown to Christmas Sale Choose from over 150 books on sale up to 70% off.

The Term Structure of Interest Rates What is it? The relationship among interest rates over different time-horizons, as viewed from today, t = 0. A concept closely related to this: The Yield Curve • Plots the effective annual yield against the number of periods an investment is held (from time t=0). exchanges such as CBOT offer contracts along the entire yield curve; others such as LIFFE provide a market in contracts on bonds denominated in a range of major currencies. So, the basis of a futures contract is the difference between the spot price of an asset and its price for future delivery as implied by the price of a futures contract written on the asset. Futures contracts are exchange

Learning Curve UNDERSTANDING DERIVATIVES Brian Eales London Metropolitan University definition of a derivative, which will help lay the foundation of this text, is: “an instrument whose existence and value is contingent upon the existence of another instrument or security”. The security on which the derivative is created may itself be a derivative and this can give rise to potentially To capture yield curve dynamics, we use a three-factor term structure model based on the classic contribution of Nelson and Siegel (1987), interpreted as a model of level, slope, and curvature, as in Diebold and Li (2002).

[PDF]Free Yield Curve Risk Factors Domestic And Global Contexts download Book Yield Curve Risk Factors Domestic And Global Contexts.pdf Federal Reserve Bank of San Francisco … 2, etc are spot interest rates based on the yield curve and n is the number of time periods in which an amount of the coupon is paid and, finally, the value when the bond is redeemed.

However the zero-coupon curve derived by models such as those described by Vasicek (1977), Brennan and Schwartz (1979) and Cox, Ingersoll and Ross (1985) do not fit the observed market rates or spot rates implied by market yields, and generally market yield curves are found to contain more variable shapes than those derived using term structure models. PDF Anyone with an involvement in the bond markets must become keenly interested in the yield curve. This applies whether one is a bond trader or bond investor, or even if one is just a student

the slope of the yield curve, but may simply be the result of changes in the short-end of the spread. In the empirical literature, a common practice to disentangle these two considerations PDF Anyone with an involvement in the bond markets must become keenly interested in the yield curve. This applies whether one is a bond trader or bond investor, or even if one is just a student

analysing and interpreting the yield curve Sun, 16 Dec 2018 09:37:00 GMT analysing and interpreting the yield pdf - Why choose a .global domain?. The world is ever Fixed Income Analytics brings together twenty influential papers written by Kenneth Garbade with members of the Cross Markets Research Group of Bankers Trust Company between 1983 and 1990. Written by and for practitioners in the U.S. Treasury securities markets, it is one of the few, if not only, books on fixed income analysis that focuses on

Fitting the Yield Curve SpringerLink

PDF Interest Rate Models – Department Mathematik. Download estimating-and-interpreting-the-yield-curve or read estimating-and-interpreting-the-yield-curve online books in PDF, EPUB and Mobi Format., Download analysing and interpreting the yield curve or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get analysing and interpreting the yield curve book now. This site is like a library, Use search box in the widget to get ebook that you want..

Yield Curve Risk Factors Domestic And Global Contexts

The Yield Curve Open Textbooks for Hong Kong. exchanges such as CBOT offer contracts along the entire yield curve; others such as LIFFE provide a market in contracts on bonds denominated in a range of major currencies. So, the basis of a futures contract is the difference between the spot price of an asset and its price for future delivery as implied by the price of a futures contract written on the asset. Futures contracts are exchange the extant literature on the yield curve as a predictor of future economic activity. In section 3, In section 3, we describe the data and the empirical tests we implement..

the slope of the yield curve, but may simply be the result of changes in the short-end of the spread. In the empirical literature, a common practice to disentangle these two considerations The comprehension of the yield curve or rather of the yield curves, spot and forward, Treasury and swap yield curves, default free and risky curves, zero-coupon and par yield curves, and so on, is the core of this book.

Yield Curve Analysis: The Fundamentals of Risk and Return [Livingston G. Douglas] on Amazon.com. *FREE* shipping on qualifying offers. Covers the time value of money, compound interest, bond prices and yields, bond price volatility, and bond return the extant literature on the yield curve as a predictor of future economic activity. In section 3, In section 3, we describe the data and the empirical tests we implement.

December 13th, 2018 - A yield curve is a graph indicating the term structure of interest rates by plotting the yields of all bonds of the same quality This book provides a thorough analysis of estimation вЂRebonato's book integrates practical aspects of yield curve investing with the most up-to-date research. It is a superb synthesis for anyone interested in rigorous analysis of these capital markets, which are among the most important globally.'

exchanges such as CBOT offer contracts along the entire yield curve; others such as LIFFE provide a market in contracts on bonds denominated in a range of major currencies. So, the basis of a futures contract is the difference between the spot price of an asset and its price for future delivery as implied by the price of a futures contract written on the asset. Futures contracts are exchange the slope of the yield curve, but may simply be the result of changes in the short-end of the spread. In the empirical literature, a common practice to disentangle these two considerations

The yield curve is the defining indicator of the international debt capital markets, and an understanding of it is significant to the clean operating of the financial system as an entire. However the zero-coupon curve derived by models such as those described by Vasicek (1977), Brennan and Schwartz (1979) and Cox, Ingersoll and Ross (1985) do not fit the observed market rates or spot rates implied by market yields, and generally market yield curves are found to contain more variable shapes than those derived using term structure models.

Yield Curve Analysis : The Fundamentals of Risk and Return by Livingston G. Douglas and a great selection of related books, art and collectibles available now at AbeBooks.com. the extant literature on the yield curve as a predictor of future economic activity. In section 3, In section 3, we describe the data and the empirical tests we implement.

There are number of excellent textbooks that the reader is encouraged to read which provides the necessary background, in particular Ingersoll (1987) and Choudhry (2004). The yield to maturity expectation hypothesis (YTM-EH) relates the riskless YTM and the Read Online or Download Convexity Bias and the Yield Curve. Understanding the Yield Curve: Part 5 PDF. Best economy books. Read e-book online Divergent Paths in Post-Communist Transformation: Capitalism PDF . The main entire and updated research of the successes and screw ups of twenty-seven nations post-communism transformation. taking a look at lifestyles after the autumn of the …

Home » Publications » Books. Book: Moving Up the Yield Curve: Advances and Obstacles, ASA Special Publication 39, 1980 . Published by: American Society of … The Term Structure of Interest Rates What is it? The relationship among interest rates over different time-horizons, as viewed from today, t = 0. A concept closely related to this: The Yield Curve • Plots the effective annual yield against the number of periods an investment is held (from time t=0).

P– (M + ∑C) = a 1 X 1 + a 2 X 2 + a 3 X 3 (8.6) where X i is the appropriate expression in square brackets in (8.5); this is the form in which the expression is commonly encountered in text books. P– (M + ∑C) = a 1 X 1 + a 2 X 2 + a 3 X 3 (8.6) where X i is the appropriate expression in square brackets in (8.5); this is the form in which the expression is commonly encountered in text books.

To get the curve duration and convexity, first shift the underlying yield curve, which in this case is the par curve, up by 25 basis points. The new 0×2 implied spot rate is 10.694755%, an increase of 26.1 basis points (0.10694755 – 0.10433927 = 0.00261). Free Download Analysing And Interpreting The Yield Curve Book PDF Keywords Free DownloadAnalysing And Interpreting The Yield Curve Book PDF, read, reading book, free, download, book, ebook, books, ebooks, manual

The yield curve, a line drawing out a bond’s maturity against its yields, is widely watched as a gauge of the bond market’s feelings over future economic prospects. A steepening curve tends to signify improving growth expectations, but some investors say is a much-needed snapback after the curve flattening move in the past few weeks had extended too far.” This newly reached number in 10 The Yield Curve as a Predictor of U.S. Recessions Arturo Estrella and Frederic S. Mishkin The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six