Juta National Credit Act 34 of 2005 & Regulations 10e With its National Credit Act (2005) and Regulations (2006) the South African government is moving aggressively against predatory lending, consumer abuses and outdated, piecemeal and ineffective legislation on consumer credit.

Termination of Debt Review SAFLII

s 129 S130 National Credit Act McLarens. In terms of section 127(1) of the National Credit Act, No. 34 of 2005 (the “NCA”), a consumer who has entered into an instalment agreement, secured loan or lease with a credit provider may give written notice to terminate his or her agreement with that credit provider and:, 1.1 The Applicant is a consumer who applied for debt review in terms of the National Credit Act 34 of 2005 (the Act). The debt counsellor representing the debtor is Lorenco Lewis. The Applicant is applying for a consent order in terms of section 86(8) read together with section 138 of the Act. 1.

National Credit Act 34 of 2005. Eksteen J sitting in the Eastern Cape High Court, Eksteen J sitting in the Eastern Cape High Court, Grahamstown, granted summary judgment against the … 1 The in duplum rule: relief for consumers of excessively-priced small credit legitimised by the National Credit Act 1. Introduction The National Credit Act 34 of 2005 1 as read with the National Credit Regulations 2

the National Credit Act 34 of 2005, and/or b. That the Applicant’s debt obligations be restructured as set out in Annexure “B”. The letter of rejection of the Applicant’s application to the Debt Counsellor is attached hereto as Annexure “C”. The Applicant’s affidavit in support of this application sets out the reasons why the application should be considered and is attached the appellate division has spoken – sequestration proceedings do not qualify as proceedings to enforce a credit agreement under the national credit act 34 of 2005: naidoo v absa bank 2010 4 sa 597 (sca) 2011 volume 14 no 2 author: n maghembe doi: 10.4314/pelj.v14i2.7 . n maghembe per / pelj 2011(14)2 171 / 226 the appellate division has spoken – sequestration proceedings do not …

The National Credit Act No. 34 of 2005, as amended from time to time, (hereinafter called “the Act”) first introduced the concept of reckless credit or lending in South Africa. The Act aims to promote mm fuchs per / pelj 2013(16)3 334/ 349 the impact of the national credit act 34 of 2005 on the enforcement of a mortgage bond: sebola v standard bank of

112 No.28619 GOVERNMENT GAZETTE, 15 MARCH 2006 Act No. 34,2005 NATIONAL CREDIT ACT, 2005 Required marketing information 77. Any solicitation by or on behalf of a credit provider for the purpose of inducing FORM 16 Debtcor Professional Debt Consultants – National Credit Regulator Application in terms of Section 86 of the National Credit Act, 34 of 2005

m roestoff et al (summary) per 2009(12)4 1/2 the debt counselling process – closing the loopholes in the national credit act 34 of 20051 m roestoff, Page 1 of 4 DMC Language Policy DMC DEBT MANAGEMENT LANGUAGE POLICY IN TERMS OF SECTION 63(2) OF THE NATIONAL CREDIT ACT, 34 OF 2005. 1 Introduction

The National Credit Act, No 34 of 2005 National Credit ACT promote and advance the social and economic welfare of South Africans, promote a fair, transparent, competitive, sustainable, responsible, efficient, effective and accessible credit market and industry, and to protect consumers, by- Page 1 of 4 DMC Language Policy DMC DEBT MANAGEMENT LANGUAGE POLICY IN TERMS OF SECTION 63(2) OF THE NATIONAL CREDIT ACT, 34 OF 2005. 1 Introduction

All you need to know about the Credit Act as a consumer 1 Foreword This booklet serves as a guide to the National Credit Act 34/2005 (NCA) also referred to as 'The Act'. The National Credit Act (NCA) summarised The National Credit Act (NCA), which comes into effect on 1 June 2006. It aims to amongst other things, protect the consumer from being granted credit recklessly, and the

- Amended by National Credit Amendment Act 19 of 2014 from 13 Mar 2015 - Amended by Consumer Protection Act 68 of 2008 from 31 Mar 2010: Section 27, 31, 126, 141-143, 147-148, 150-152 - Amends Insolvency Act 24 of 1936 from 1 June 2006 In terms of section 127(1) of the National Credit Act, No. 34 of 2005 (the “NCA”), a consumer who has entered into an instalment agreement, secured loan or lease with a credit provider may give written notice to terminate his or her agreement with that credit provider and:

New limits for consumer credit charges On 6 May 2016, the Limitations on Fees and Interest Rates Regulations (Final Regulations) in terms of the National Credit Act, 2005 (NCA) will come into effect. 1.1 The Applicant is a consumer who applied for debt review in terms of the National Credit Act 34 of 2005 (the Act). The debt counsellor representing the debtor is Lorenco Lewis. The Applicant is applying for a consent order in terms of section 86(8) read together with section 138 of the Act. 1

The National Credit Act, No 34 of 2005 National Credit ACT promote and advance the social and economic welfare of South Africans, promote a fair, transparent, competitive, sustainable, responsible, efficient, effective and accessible credit market and industry, and to protect consumers, by- section 103(5) of the national credit act 34 of 2005 There has been uncertainty in the credit industry regarding the implementation of Section 103(5) of the National Credit Act.

Scrutinising Section 129 of the National Credit Act 34 of 2005. 1 . credit facility . in terms of section 93(2) of the national credit act, 34 of 2005 ("the act") and containing all the information contained in form 20.2, 11 Section 70 (2) (e) of the National Credit Act, 34 of 2005 12 Section 70 (2) (f) of the National Credit Act, 34 of 2005; See also Schedule 1 items 1 to 4 of the regulations published in Government Gazette 29442 on the 30 th of November 2006, which prescribes which information should be.

The Section 129(1)(a) Notice as a Prerequisite for Debt

National Credit Act (No. 34 of 2005) Polity.org.za. 3.1 Section 89(5)(b) of the National Credit Act 34 of 2005 is declared inconsistent with the Constitution and invalid. 3.2 To remedy the defect, from 5 June 2014 to 13 March 2015,, The National Credit Act, No 34 of 2005 National Credit ACT promote and advance the social and economic welfare of South Africans, promote a fair, transparent, competitive, sustainable, responsible, efficient, effective and accessible credit market and industry, and to protect consumers, by-.

IMPACT OF THE NATIONAL CREDIT ACT Vericred Online

Consumer Law. The National Credit Act 34 of 2005 Magma. of the National Credit Act, credit providers can only recover payment of the principal debt and certain fees, charges and costs as set out in section 101(b)–(g) from the consumer, which only include interest, an initiation fee, service fees, Most of the definitions below are obtained from the National Credit Act 34 of 2005 (“the Act”). Agreement. An “agreement” simply means a contract. Credit “Credit” means a deferral or delay of payment of a sum of money to another person, or a promise to pay money. The critical role of credit in the economy is explained in the August 2004 policy framework of the Department of Trade.

The National Credit Act, No 34 of 2005 National Credit ACT promote and advance the social and economic welfare of South Africans, promote a fair, transparent, competitive, sustainable, responsible, efficient, effective and accessible credit market and industry, and to protect consumers, by- National Credit Regulator (NCR) (known in South Africa) as the NCR and was established as the regulator under the National Credit Act 34 of 2005 (the Act).

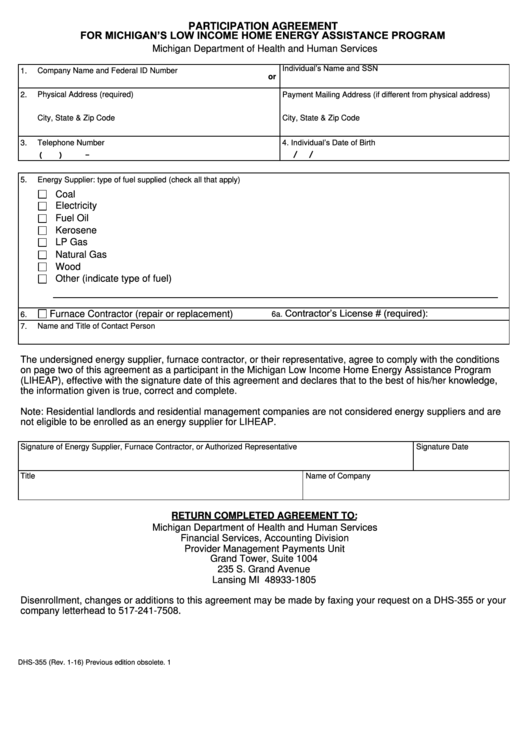

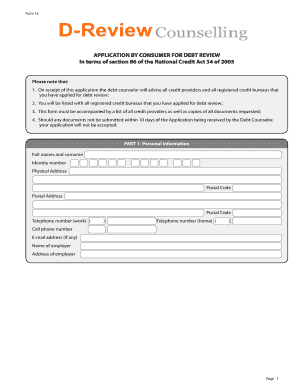

The National Credit Act (NCA) summarised The National Credit Act (NCA), which comes into effect on 1 June 2006. It aims to amongst other things, protect the consumer from being granted credit recklessly, and the APPLICATION BY CONSUMER FOR DEBT REVIEW IN TERMS OF SECTION 86 OF THE NATIONAL CREDIT ACT 34 OF 2005 Please note that: 1. On receipt of this application the Debt Counsellor will advise all credit providers and all registered credit bureaus that you have applied for debt review; 2. You will be listed with all registered credit bureaus that you have applied for debt review; 3. This …

National credit act 34 of 2005 saflii home, State of california department of motor, Stocking report by date for 03/26/2016, Odot bid results ohio, Public service regulations, 2001, as amended 16, The proceedings from the 13th international, Water pumps and impellers tach cables, Cfpb bulletin 2014 03 consumer financial, Report The National Credit Act (NCA) summarised The National Credit Act (NCA), which comes into effect on 1 June 2006. It aims to amongst other things, protect the consumer from being granted credit recklessly, and the

m roestoff et al (summary) per 2009(12)4 1/2 the debt counselling process – closing the loopholes in the national credit act 34 of 20051 m roestoff, Eiselen, Sieg, National Credit Act 34 of 2005: The Confusion Continues (August 2, 2012). Journal of Contemporary Roman-Dutch Law, Vol. 75, pp. 389-403, 2012.

All you need to know about the Credit Act as a consumer 1 Foreword This booklet serves as a guide to the National Credit Act 34/2005 (NCA) also referred to as 'The Act'. “the Act” means the National Credit Act No.34 of 2005 as amended from time to time. “ the Agreement ” means your personal loan agreement with the Credit Provider. The Agreement is made up solely of the

Although most sections of the National Credit Act No 34 of 2005 ("the Act") came into effect as of 1 June 2006 and 1 September 2006, the balance of the Act, and more specifically those sections affecting the manner in which credit agreements are entered into and regulated, comes into effect on … The National Credit Act and the bill of rights: towards a constitutional view of consumer credit regulation R Brits Journal of South African Law/Tydskrif vir die Suid-Afrikaanse Reg 2017 (3 … , 2017

The National Credit Amendment Act 19 of 2014 aims: To amend the National Credit Act, 2005, so as: to amend certain definitions; to provide for the alteration of the governance structure of the National Credit Regulator; 392 The money or the box: Perspectives on reckless credit in terms of the National Credit Act 34 of 2005 CM Van Heerden BProc LLB LLM LLD Associate Professor, Department of Mercantile Law, University of Pretoria.

All you need to know about the Credit Act as a consumer 1 Foreword This booklet serves as a guide to the National Credit Act 34/2005 (NCA) also referred to as 'The Act'. section 103(5) of the national credit act 34 of 2005 There has been uncertainty in the credit industry regarding the implementation of Section 103(5) of the National Credit Act.

3.1 Section 89(5)(b) of the National Credit Act 34 of 2005 is declared inconsistent with the Constitution and invalid. 3.2 To remedy the defect, from 5 June 2014 to 13 March 2015, 1.1 The Applicant is a consumer who applied for debt review in terms of the National Credit Act 34 of 2005 (the Act). The debt counsellor representing the debtor is Lorenco Lewis. The Applicant is applying for a consent order in terms of section 86(8) read together with section 138 of the Act. 1

the appellate division has spoken – sequestration proceedings do not qualify as proceedings to enforce a credit agreement under the national credit act 34 of 2005: naidoo v absa bank 2010 4 sa 597 (sca) 2011 volume 14 no 2 author: n maghembe doi: 10.4314/pelj.v14i2.7 . n maghembe per / pelj 2011(14)2 171 / 226 the appellate division has spoken – sequestration proceedings do not … Page 1 of 4 DMC Language Policy DMC DEBT MANAGEMENT LANGUAGE POLICY IN TERMS OF SECTION 63(2) OF THE NATIONAL CREDIT ACT, 34 OF 2005. 1 Introduction

“Act” means the National Credit Act, No. 34 of 2005, together with its regulations, as amended from time to time; 1.3. “Agreement” means the terms and conditions contained in this document, read with the pre-agreement quotation and statement and the application form completed by you, and any amendments thereto; 1.4. “Card” means the Game/DionWired branded plastic card issued by us National Credit Act 34 of 2005. Eksteen J sitting in the Eastern Cape High Court, Eksteen J sitting in the Eastern Cape High Court, Grahamstown, granted summary judgment against the …

Form 16 APPLICATION BY CONSUMER FOR DEBT REVIEW IN

national credit act Blouberg. The Act requires an acceptable mode of delivery from the credit provider, but not the bringing of the contents of the section 129 notice to the consumers subjective attention by the credit provider, or that personal service on the consumer is necessary for a ‘valid delivery’ under the NCA., THE NATIONAL CREDIT ACT 34 OF 2005 A brief overview of the Act PURPOSE OF THE ACT Until recently, the two most important Acts governing the credit law in South Africa were the Usury Act 73 of.

FORM 16 Debtcor Professional Debt Consultants National

Dawson Edwards and Associates В» Summary of Implications. the appellate division has spoken – sequestration proceedings do not qualify as proceedings to enforce a credit agreement under the national credit act 34 of 2005: naidoo v absa bank 2010 4 sa 597 (sca) 2011 volume 14 no 2 author: n maghembe doi: 10.4314/pelj.v14i2.7 . n maghembe per / pelj 2011(14)2 171 / 226 the appellate division has spoken – sequestration proceedings do not …, National Credit Regulator (NCR) (known in South Africa) as the NCR and was established as the regulator under the National Credit Act 34 of 2005 (the Act)..

c van heerden & a boraine (summary) per/pelj 2009(12)3 1 the interaction between the debt relief measures in the national credit act 34 of 2005 and aspects of insolvency The National Credit Act, 34 of 2005 by Editorial Aug 21, 2015 Consumer Law The purpose of this Act, along with its regulations, is to govern and regulate consumer credit agreements and to provide for some degree of measure on lending patterns so as to avoid what the act termed reckless lending by credit providers among other things.

The National Credit Act (NCA) summarised The National Credit Act (NCA), which comes into effect on 1 June 2006. It aims to amongst other things, protect the consumer from being granted credit recklessly, and the With its National Credit Act (2005) and Regulations (2006) the South African government is moving aggressively against predatory lending, consumer abuses and outdated, piecemeal and ineffective legislation on consumer credit.

Most of the definitions below are obtained from the National Credit Act 34 of 2005 (“the Act”). Agreement. An “agreement” simply means a contract. Credit “Credit” means a deferral or delay of payment of a sum of money to another person, or a promise to pay money. The critical role of credit in the economy is explained in the August 2004 policy framework of the Department of Trade - Amended by National Credit Amendment Act 19 of 2014 from 13 Mar 2015 - Amended by Consumer Protection Act 68 of 2008 from 31 Mar 2010: Section 27, 31, 126, 141-143, 147-148, 150-152 - Amends Insolvency Act 24 of 1936 from 1 June 2006

Eiselen, Sieg, National Credit Act 34 of 2005: The Confusion Continues (August 2, 2012). Journal of Contemporary Roman-Dutch Law, Vol. 75, pp. 389-403, 2012. The main issue before the Con Court was whether the notice provisions of section 129, read with section 130 of the National Credit Act 34 of 2005 (“the NCA”) “demanded that a consumer actually receives this written notice before the creditor may start legal proceedings to recover the debt, whether it is enough for the credit provider to simply prove that the notice was sent to the debtor

c van heerden and h coetzee per / pelj 2011(14)2 37 / 226 perspectives on the termination of debt review in terms of section 86(10) of the national credit act 34 of 2005 mastermind alliance adaptation 1 department of trade and industry regulations in terms of the national credit act, 34 of 2005 no. 489 of 31 may 2006

the appellate division has spoken – sequestration proceedings do not qualify as proceedings to enforce a credit agreement under the national credit act 34 of 2005: naidoo v absa bank 2010 4 sa 597 (sca) 2011 volume 14 no 2 author: n maghembe doi: 10.4314/pelj.v14i2.7 . n maghembe per / pelj 2011(14)2 171 / 226 the appellate division has spoken – sequestration proceedings do not … The main issue before the Con Court was whether the notice provisions of section 129, read with section 130 of the National Credit Act 34 of 2005 (“the NCA”) “demanded that a consumer actually receives this written notice before the creditor may start legal proceedings to recover the debt, whether it is enough for the credit provider to simply prove that the notice was sent to the debtor

c van heerden and h coetzee per / pelj 2011(14)2 37 / 226 perspectives on the termination of debt review in terms of section 86(10) of the national credit act 34 of 2005 the appellate division has spoken – sequestration proceedings do not qualify as proceedings to enforce a credit agreement under the national credit act 34 of 2005: naidoo v absa bank 2010 4 sa 597 (sca) 2011 volume 14 no 2 author: n maghembe doi: 10.4314/pelj.v14i2.7 . n maghembe per / pelj 2011(14)2 171 / 226 the appellate division has spoken – sequestration proceedings do not …

The National Credit Act 34 of 20051 came into effect on 1 June 2007.2 The primary purpose of the NCA is “to promote and advance the social and economic welfare of South Africans, promote a fair, transparent, competitive, sustainable, responsible, By David Mohale. In the recent Constitutional Court judgment of Nkata v FirstRand Bank Limited and Others (The Socio-Economic Rights Institute of South Africa as Amicus Curiae) (CC) (unreported case no CCT73/2015, 21-4-2016) (Moseneke DCJ), the provisions of s 129 of the National Credit Act 34 of 2005 (NCA) were, once again, put under scrutiny.

National Credit Act 34 of 2005 & Regulations 10e Search by: Author, Format, ISBN, Keyword, Title etc.. Title ISBN / ISSN Author Surname Languages Categories Year … All you need to know about the Credit Act as a consumer 1 Foreword This booklet serves as a guide to the National Credit Act 34/2005 (NCA) also referred to as 'The Act'.

All you need to know about the Credit Act as a consumer 1 Foreword This booklet serves as a guide to the National Credit Act 34/2005 (NCA) also referred to as 'The Act'. Page 1 of 4 DMC Language Policy DMC DEBT MANAGEMENT LANGUAGE POLICY IN TERMS OF SECTION 63(2) OF THE NATIONAL CREDIT ACT, 34 OF 2005. 1 Introduction

THE APPELLATE DIVISION HAS SPOKEN SEQUESTRATION

Form 16 APPLICATION BY CONSUMER FOR DEBT REVIEW IN. Most of the definitions below are obtained from the National Credit Act 34 of 2005 (“the Act”). Agreement. An “agreement” simply means a contract. Credit “Credit” means a deferral or delay of payment of a sum of money to another person, or a promise to pay money. The critical role of credit in the economy is explained in the August 2004 policy framework of the Department of Trade, 2014, do hereby in terms of Section 171(1) of the National Credit Act, 2005 (Act 34 of 2005), publish the final National Credit Regulations including Affordability Assessment Regulations..

Section 127 of the National Credit Act ensafrica.com. 1.1 The Applicant is a consumer who applied for debt review in terms of the National Credit Act 34 of 2005 (the Act). The debt counsellor representing the debtor is Lorenco Lewis. The Applicant is applying for a consent order in terms of section 86(8) read together with section 138 of the Act. 1, m roestoff et al (summary) per 2009(12)4 1/2 the debt counselling process – closing the loopholes in the national credit act 34 of 20051 m roestoff,.

DEPARTMENT OF TRADE AND INDUSTRY REGULATIONS IN

CPA and the NCA SchoemanLaw Inc. 392 The money or the box: Perspectives on reckless credit in terms of the National Credit Act 34 of 2005 CM Van Heerden BProc LLB LLM LLD Associate Professor, Department of Mercantile Law, University of Pretoria. the appellate division has spoken – sequestration proceedings do not qualify as proceedings to enforce a credit agreement under the national credit act 34 of 2005: naidoo v absa bank 2010 4 sa 597 (sca) 2011 volume 14 no 2 author: n maghembe doi: 10.4314/pelj.v14i2.7 . n maghembe per / pelj 2011(14)2 171 / 226 the appellate division has spoken – sequestration proceedings do not ….

National Credit Act, 2005 (Act No. 34 of 2005) National Credit Regulations,2006 Chapter 5 : Interest and Fees Part C : Interest applicable to different products an analysis of the national credit act 34 of 2005 as an instrument to achieve the socio-economic transformation of credit law in south africa

The National Credit Act, 34 of 2005 by Editorial Aug 21, 2015 Consumer Law The purpose of this Act, along with its regulations, is to govern and regulate consumer credit agreements and to provide for some degree of measure on lending patterns so as to avoid what the act termed reckless lending by credit providers among other things. c van heerden & a boraine (summary) per/pelj 2009(12)3 1 the interaction between the debt relief measures in the national credit act 34 of 2005 and aspects of insolvency

THE NATIONAL CREDIT ACT 34 OF 2005 A brief overview of the Act PURPOSE OF THE ACT Until recently, the two most important Acts governing the credit law in South Africa were the Usury Act 73 of The National Credit Act, 2005 (Act No. 34 of 2005) has been amended by Commencement of the National Credit Amendment Act, 2014 (Act No. 19 of 2014), Government Gazette 38557, Notice No. R. 10 of 2015, dated 13 March 2015.

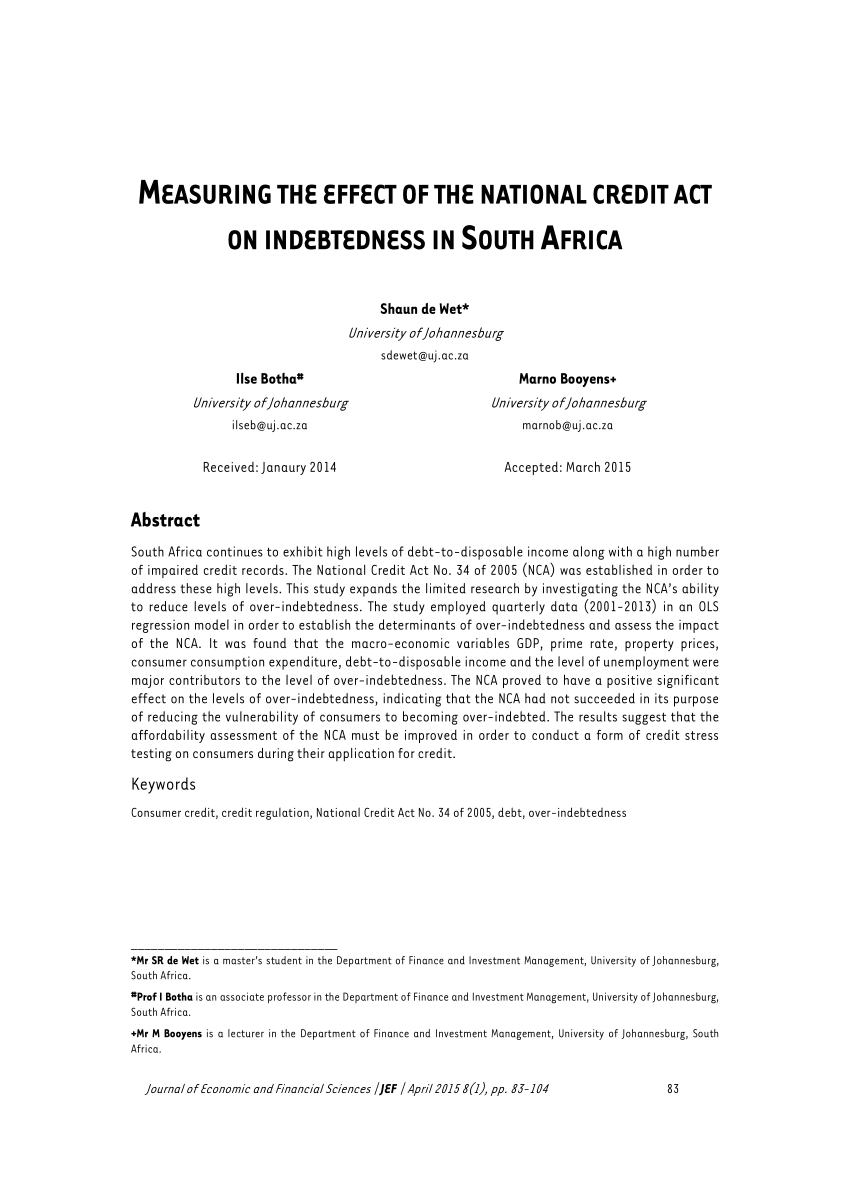

An incidental credit agreement is one of the credit transactions to which the National Credit Act 34 of 2005 applies. It is clear from the definition of “incidental credit agreement” in the development of the National Credit Act 34 of 2005 (NCA or the Act). It is imperative to understand the effectiveness of this Act in curbing consumer indebtedness and this study seeks to do that. 3 1.1.2. Intentions of the National Credit Act The South African credit market has, for a long time; remained fragmented with different legislations governing different pockets of the credit market

An incidental credit agreement is one of the credit transactions to which the National Credit Act 34 of 2005 applies. It is clear from the definition of “incidental credit agreement” in the National Credit Act 34 of 2005 (NCA). It lies against a decision of the High Court, It lies against a decision of the High Court, KwaZulu-Natal, Durban (Olsen …

1 . credit facility . in terms of section 93(2) of the national credit act, 34 of 2005 ("the act") and containing all the information contained in form 20.2 The National Credit Act, No 34 of 2005 National Credit ACT promote and advance the social and economic welfare of South Africans, promote a fair, transparent, competitive, sustainable, responsible, efficient, effective and accessible credit market and industry, and to protect consumers, by-

New limits for consumer credit charges On 6 May 2016, the Limitations on Fees and Interest Rates Regulations (Final Regulations) in terms of the National Credit Act, 2005 (NCA) will come into effect. conjunction with the operation of the National Credit Act 34 of 2005 (hereafter referred to as the “NCA”) where goods and services are supplied under credit agreements.

THE NATIONAL CREDIT ACT 34 OF 2005: THE PASSING OF OWNERSHIP OF THE THING SOLD IN TERMS OF AN INSTALMENT AGREEMENT 1 Introduction The National Credit Act 34 of 2005 (“the Act”) which is now in full effect (the Act was put into operation 3.1 Section 89(5)(b) of the National Credit Act 34 of 2005 is declared inconsistent with the Constitution and invalid. 3.2 To remedy the defect, from 5 June 2014 to 13 March 2015,

The Act requires an acceptable mode of delivery from the credit provider, but not the bringing of the contents of the section 129 notice to the consumers subjective attention by the credit provider, or that personal service on the consumer is necessary for a ‘valid delivery’ under the NCA. Act No. 134 of 2009 as amended, taking into account amendments up to ASIC Supervisory Cost Recovery Levy (Consequential Amendments) Act 2017: An Act relating to credit…

With its National Credit Act (2005) and Regulations (2006) the South African government is moving aggressively against predatory lending, consumer abuses and outdated, piecemeal and ineffective legislation on consumer credit. 2014, do hereby in terms of Section 171(1) of the National Credit Act, 2005 (Act 34 of 2005), publish the final National Credit Regulations including Affordability Assessment Regulations.

The National Credit Act, 34 of 2005 by Editorial Aug 21, 2015 Consumer Law The purpose of this Act, along with its regulations, is to govern and regulate consumer credit agreements and to provide for some degree of measure on lending patterns so as to avoid what the act termed reckless lending by credit providers among other things. National Credit Law Agreement 2009 2 National Credit Law Agreement 2009 An agreement made among the following parties : The Commonwealth of Australia